Get the free phantom stock agreement template

Show details

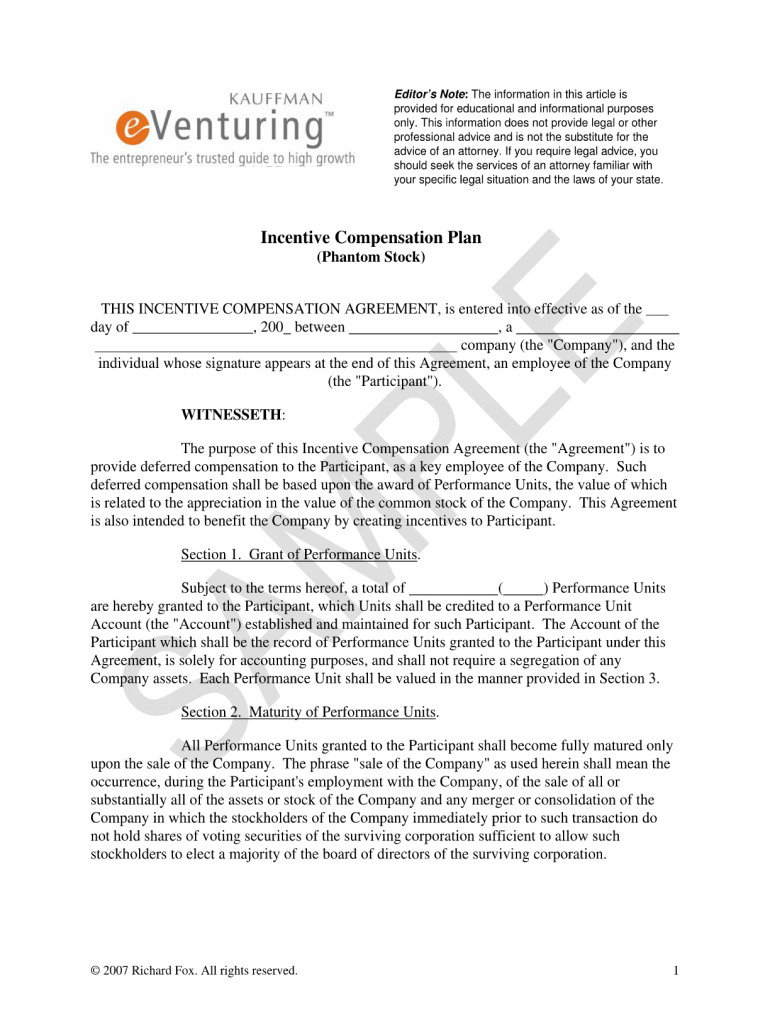

Editor's Note: The information in this article is provided for educational and informational purposes only. This information does not provide legal or other professional advice and is not the substitute

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

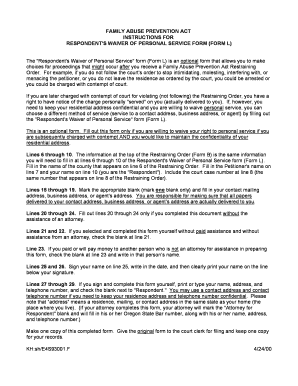

Edit your phantom equity agreement template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your phantom stock agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is an example of an appreciation only plan online

Here are the steps you need to follow to get started with our professional PDF editor:

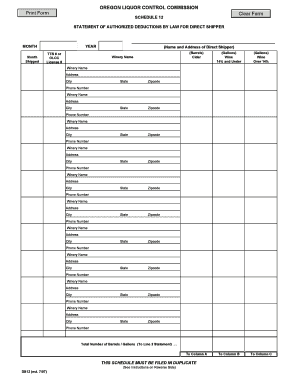

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit phantom equity agreement form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

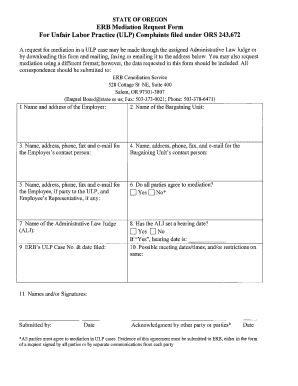

How to fill out phantom stock plan template form

01

To fill out a phantom equity plan sample, start by understanding the purpose and structure of the plan. Familiarize yourself with the terms and conditions, such as vesting periods, payout formulas, and eligibility criteria.

02

Review the phantom equity plan sample thoroughly. Pay close attention to any instructions or guidance provided. Take the time to understand the specific information required for each section, such as participant details, equity grant amounts, and performance goals.

03

Gather the necessary information and documentation. This may include employee data, company financials, and performance metrics. Ensure that you have clear and accurate data to support the calculations and provisions within the phantom equity plan sample.

04

Customize the phantom equity plan sample to fit your specific needs. Adapt the language, terminology, and calculations to align with your company's policies and practices. Make sure the plan reflects the goals and objectives you want to achieve through the issuance of phantom equity.

05

Fill out all sections of the phantom equity plan sample accurately and completely. Enter the required information precisely and double-check for any errors or omissions. Pay attention to formatting and presentation to ensure the plan is clear and easy to understand.

Who needs a phantom equity plan sample?

01

Startups and small businesses: Phantom equity plans can be a valuable tool for attracting and retaining talented employees in cash-constrained startups and small businesses. By offering a potential share in the company's future success, these plans can provide employees with a sense of ownership and motivation.

02

Established companies: Larger companies may also utilize phantom equity plans as an additional incentive and retention strategy. These plans can align employee interests with the company's long-term success, fostering loyalty and dedication.

03

Private companies: Phantom equity plans can be particularly beneficial for private companies, as they offer a way to provide employees with financial incentives without diluting ownership or going through the complexities of issuing traditional stock options or restricted stock.

In summary, to fill out a phantom equity plan sample, follow the provided instructions, gather necessary information, customize the plan to fit your needs, and complete all sections accurately. This type of plan can be beneficial for startups, small businesses, established companies, and private companies looking to offer employees a stake in the company's success without directly granting equity.

Fill

phantom equity agreement sample

: Try Risk Free

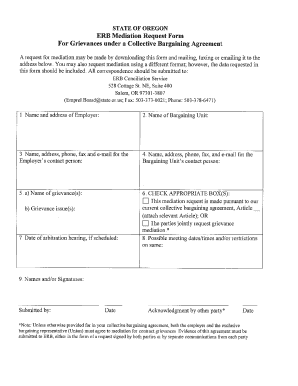

People Also Ask about equity compensation agreement template

What is a phantom equity plan?

What Is a Phantom Stock Plan? A phantom stock plan is an employee benefit plan that gives selected employees (senior management) many of the benefits of stock ownership without actually giving them any company stock. This type of plan is sometimes referred to as shadow stock.

What is an example of a phantom share plan?

For example, suppose an employee received 10 phantom shares with a starting value of $7, and assume the shares are valued on the payment date at $15. At the date of payment the employee would receive $150 under a “full value” plan and $80 under an “appreciation only” plan.

Is phantom stock a good idea?

Phantom stock is not a good idea if the company is planning on issuing it to most or all employees, especially if the phantom shares will be paid out when the employee leaves the company or retires. In that case, phantom shares may be ruled illegal because of the Employee Retirement Income and Security Act (ERISA).

How do you create a phantom stock plan?

Take a look at five tips for creating a phantom stock plan below: Understand what you are — and aren't — offering. Set a proper valuation. Create your shares. Decide how to award stock. Set a reward schedule.

What are the benefits of phantom equity?

How does an employer benefit from phantom stock? Phantom equity program is a strategy that companies use to motivate employees and increase productivity by giving them a stake in the company. It also helps the company earn more profits by driving the company stocks higher.

How do you calculate phantom stock value?

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the phantom stock plan in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your sample phantom stock agreement.

Can I create an eSignature for the llc phantom equity plan sample in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your phantom stock plan sample right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit phantom equity on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign phantom stock plan example. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is phantom stock agreement template?

A phantom stock agreement template is a document used by companies to outline the terms and conditions of a phantom stock plan, which provides employees with a cash bonus tied to the value of the company's stock without granting actual stock.

Who is required to file phantom stock agreement template?

Typically, companies that implement a phantom stock plan must maintain the agreement for their records and may be required to file it with regulatory authorities depending on jurisdiction and company policy.

How to fill out phantom stock agreement template?

To fill out a phantom stock agreement template, an employer must provide specific information such as the number of phantom shares granted, the vesting schedule, the terms for payout, and any conditions for termination or forfeiture.

What is the purpose of phantom stock agreement template?

The purpose of a phantom stock agreement template is to formalize the arrangement between an employee and the company regarding the incentive structure tied to company performance, without transferring actual equity.

What information must be reported on phantom stock agreement template?

The phantom stock agreement template must report details such as the grant date, number of phantom shares, vesting conditions, payout terms, and any specific provisions relating to termination or change of ownership.

Fill out your phantom stock agreement template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Phantom Equity Agreement Llc is not the form you're looking for?Search for another form here.

Keywords relevant to phantom shares

Related to phantom shares agreement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.